Many companies operate on a make-to-order model, like custom jewelry shops, furniture, wedding favors, or even machine parts. Service industries that require reservations, like room rentals and nail salons may also often collect deposits at the time of order or reservation. This confirms the order's legitimacy and seriousness, with the remaining balance to be collected once the product or service has been completed.

Although this process is common, managing these types of orders may be troublesome. For instance: Should the total amount on the order reflect the full amount or just the deposit? How should the deposit and balance be recorded and tracked?

This article will introduce a simple sheet design that can clearly present both deposit and balance details in an order, streamlining the overall management and administrative process.

If you'd like to clearly record each deposit, outstanding balance, and payment status for any order, you only need to add these three fields: "Deposit", "Balance", and "Payment Status". We'll use Ragic's built-in "Sales Order" template as an example to demonstrate this set up:

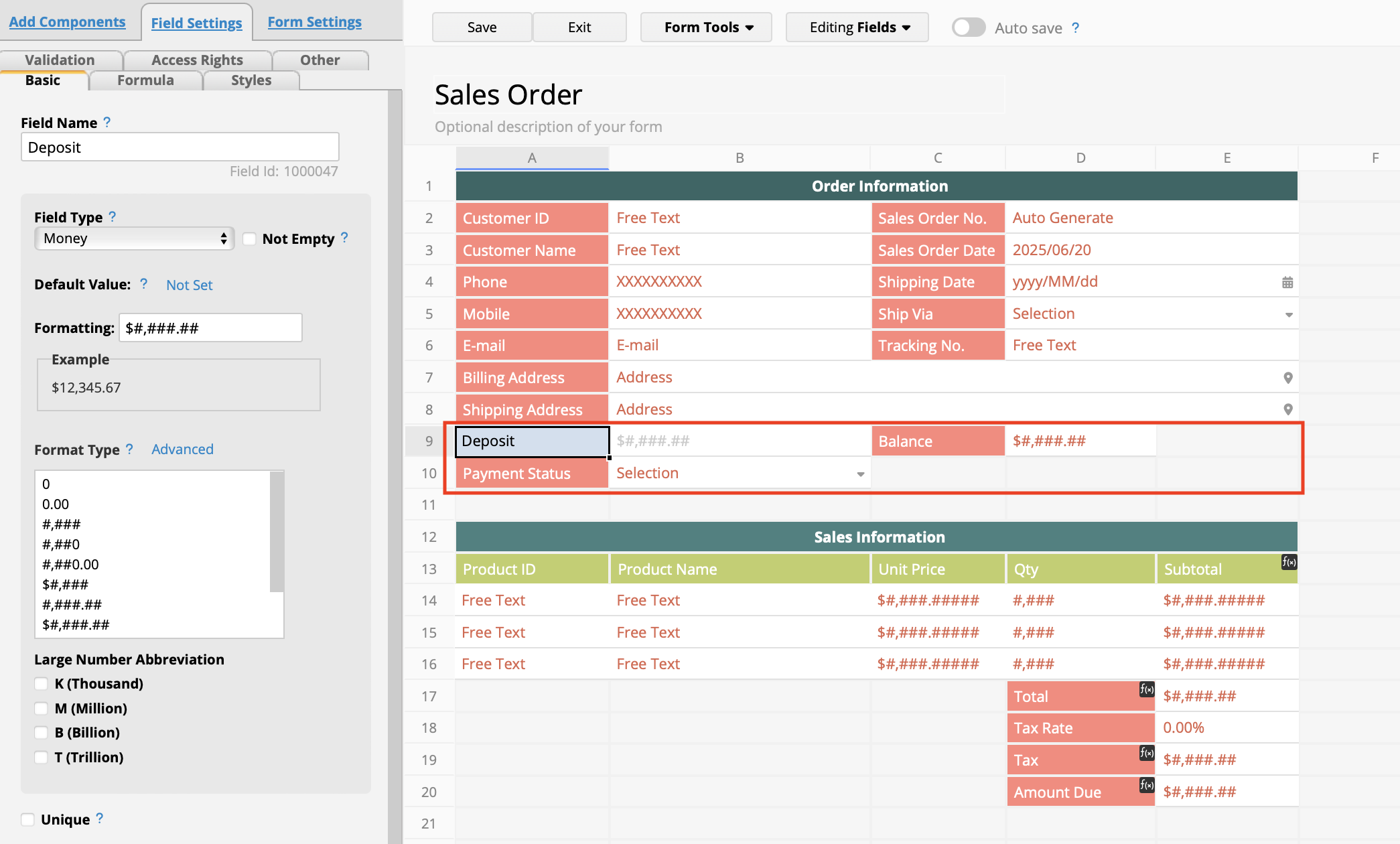

1. On the "Sales Order" sheet, add two Money (currency) fields: One more "Deposit" and one for "Balance". Next, add one Selection field for "Payment Status".

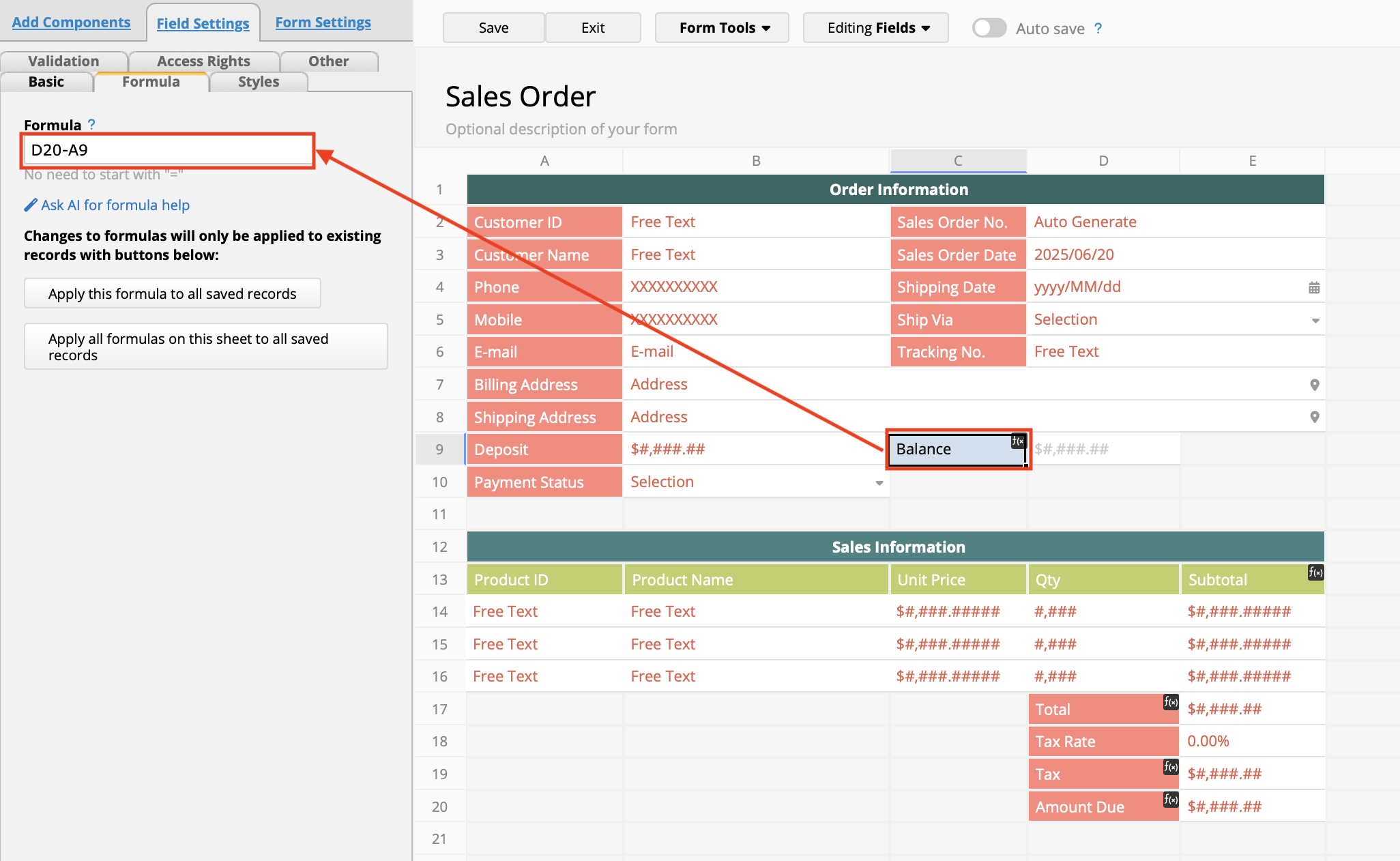

2. Set the formula for the "Balance" field as D20 - A9, which is "Amount Due" - "Deposit".

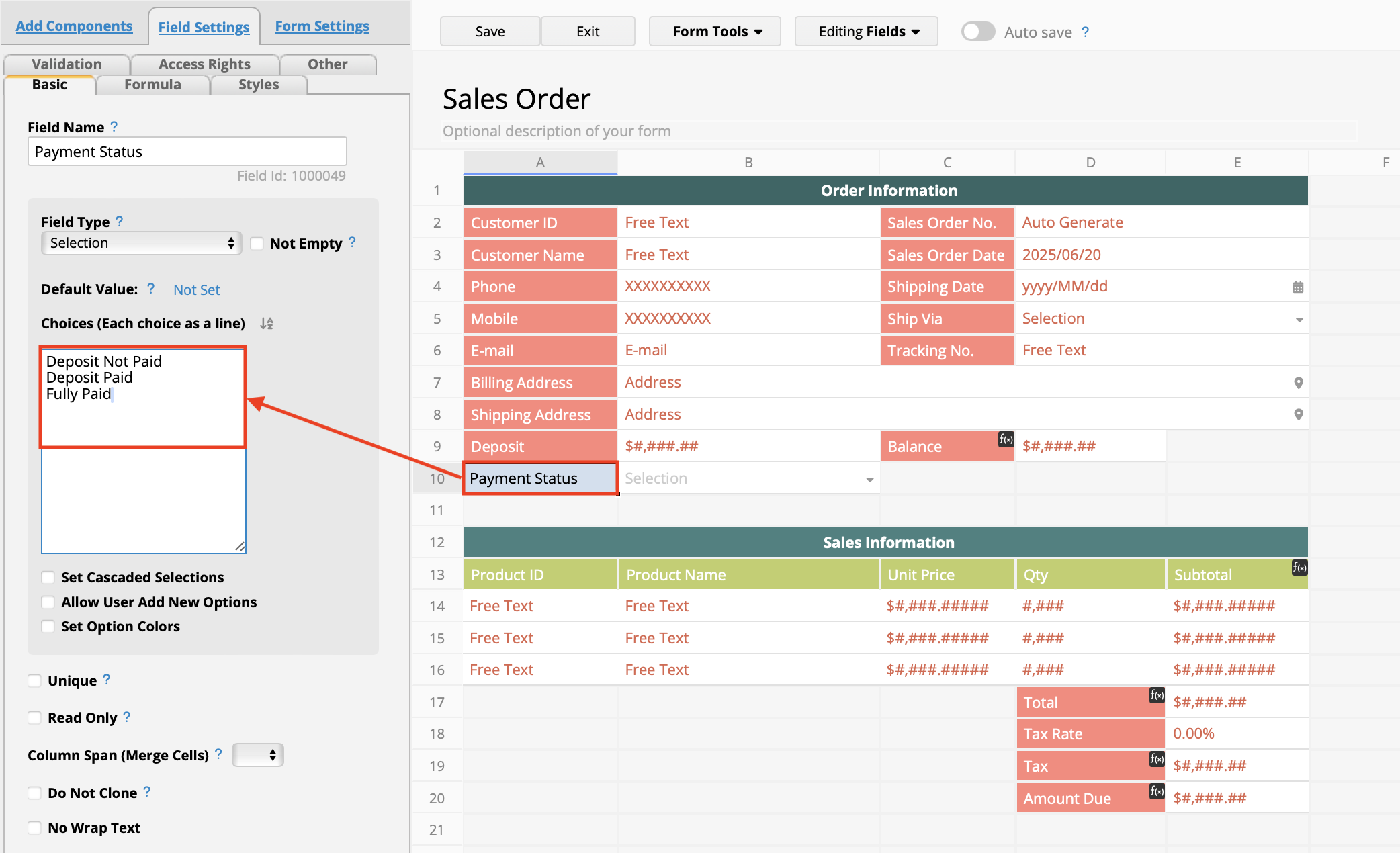

3. Set the options for the "Payment Status" field as: "Deposit Not Paid", "Deposit Paid", and "Fully Paid".

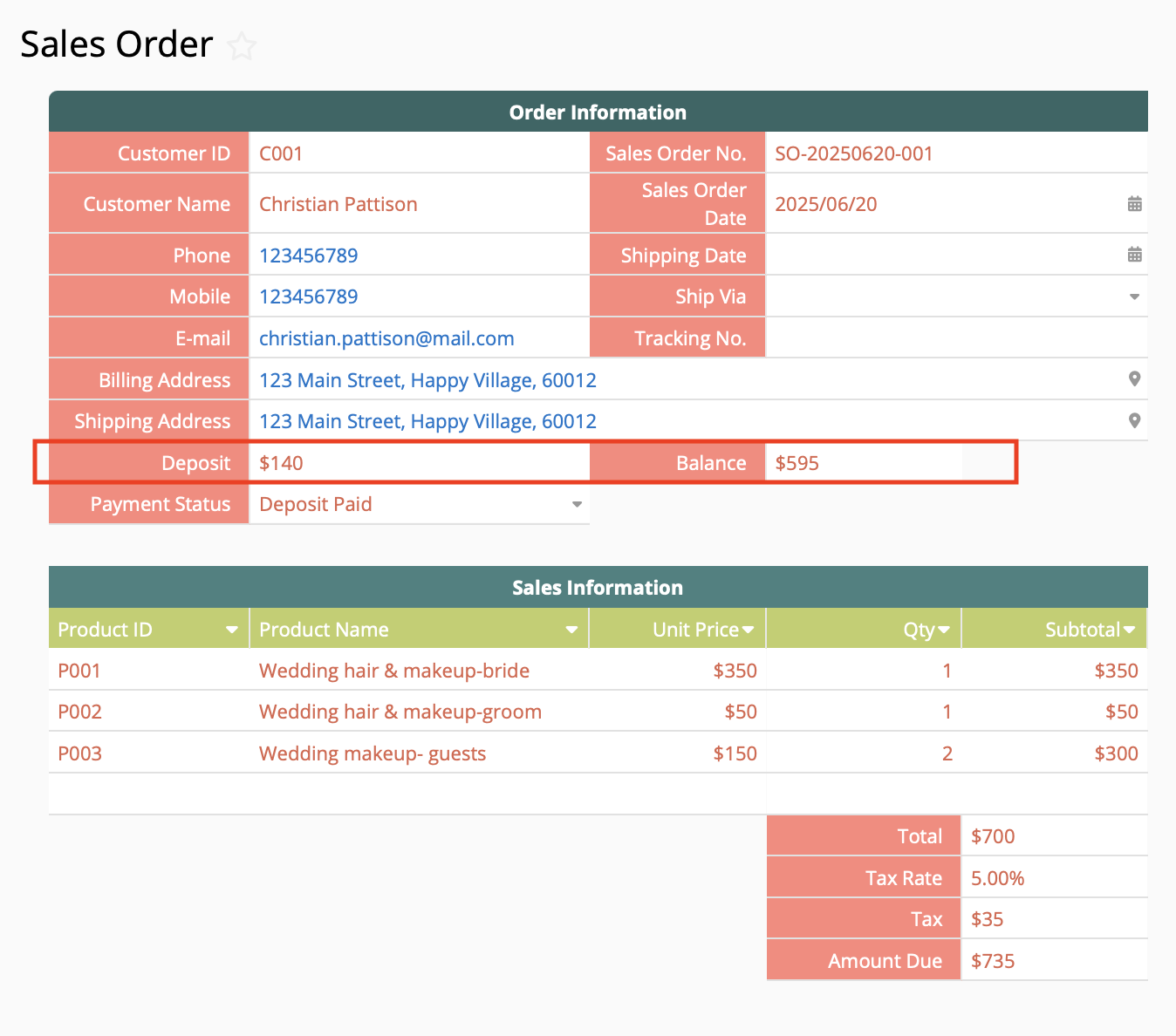

4. Once setup is complete, you can enter the customer's deposit amount and update the order status accordingly. The balance will be automatically calculated using the formula.

As demonstrated above, you can easily add the "Deposit" and "Balance" fields into your "Sales Order" sheet and use the "Payment Status" field to track payment progress. However, if your company has accounting or financial requirements that require deposits to be recorded and transferred to the bank as soon as they are received, these amount should be entered into your billing process (or accounts receivable) records early to ensure clarity and traceability.

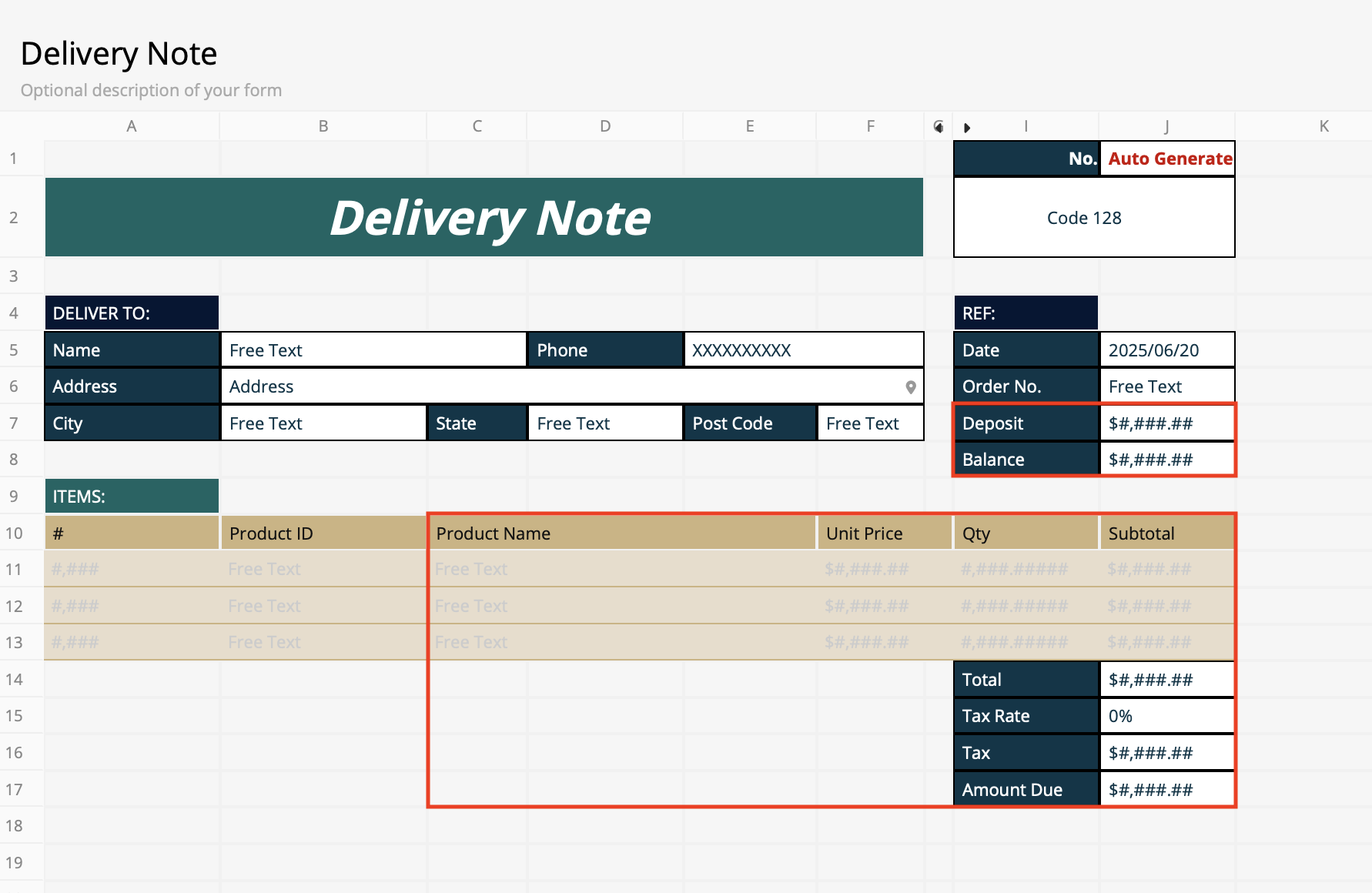

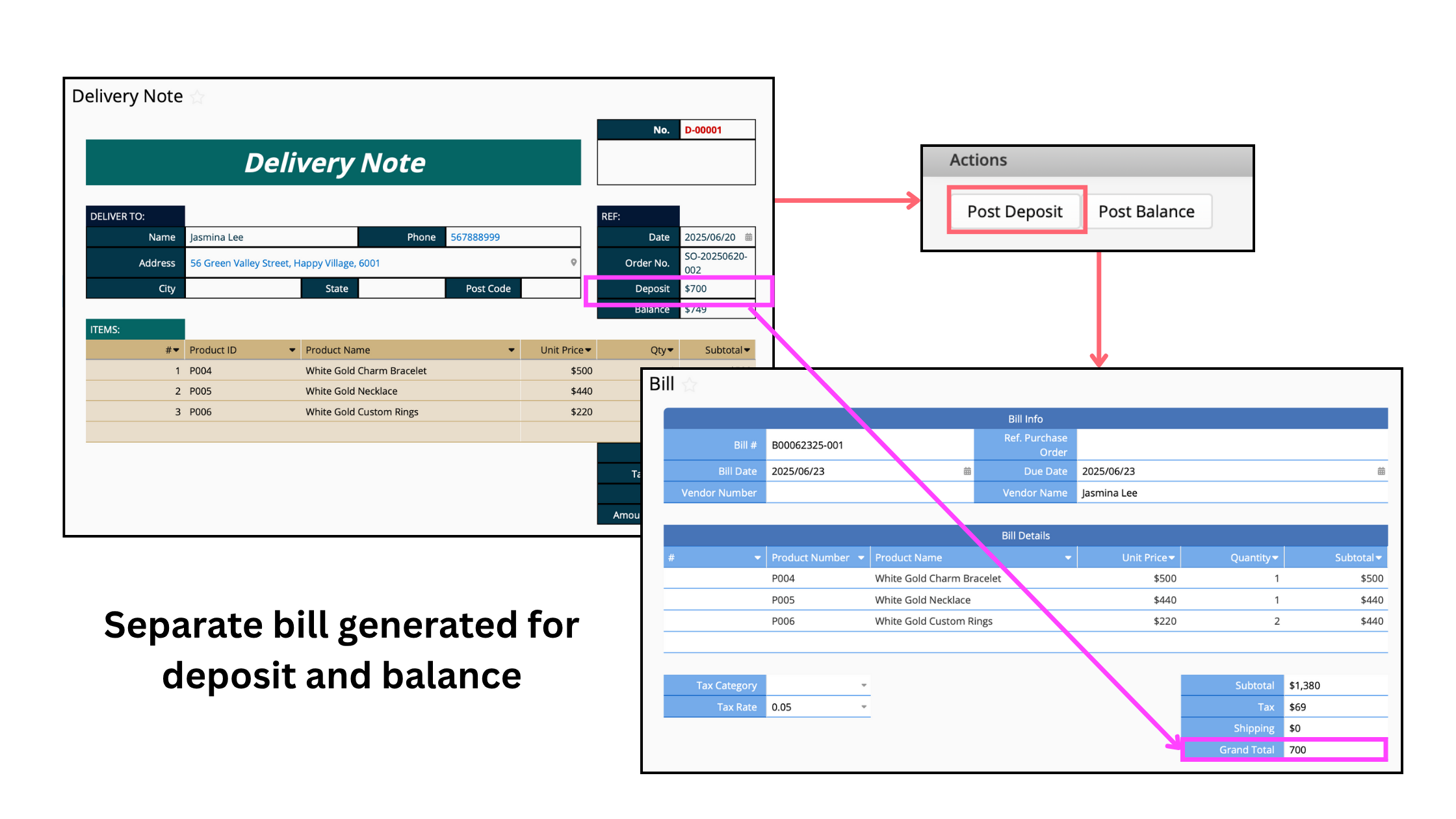

In this case, you can consider adding "Deposit" and "Balance" fields on the "Delivery Note" sheet and post these amounts to separate invoices. This approach clearly splits the bill into 2 separate sources and aligns with accounting needs for posting and ledger entries.

Let's use the "Delivery Note" and "Bill" templates to demonstrate this below:

1. Add 2 fields to the "Delivery Note" sheet: "Deposit" and "Balance". You can also adjust the delivery items Subtable to include relevant fields from the "Order" sheet's line items.

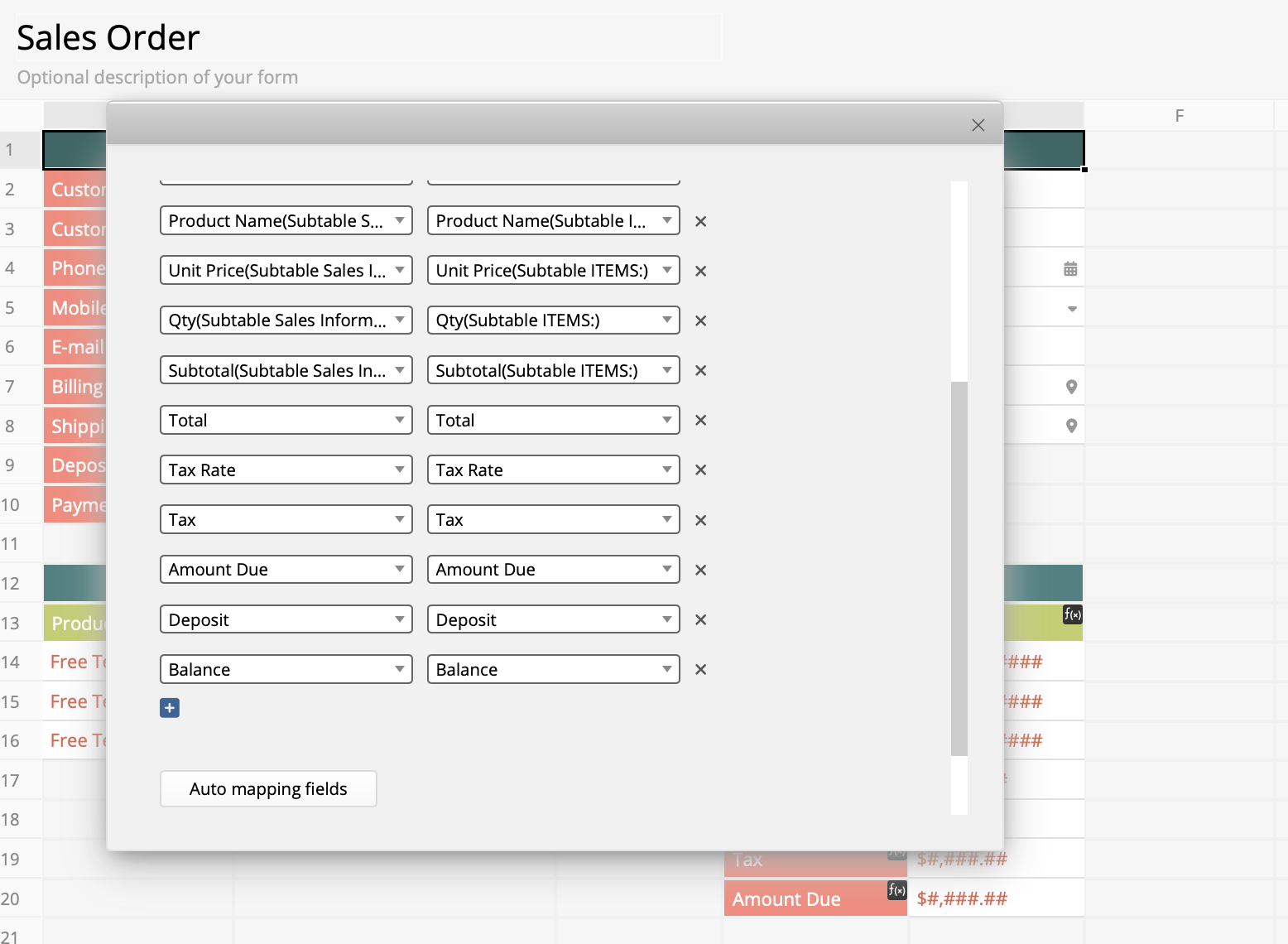

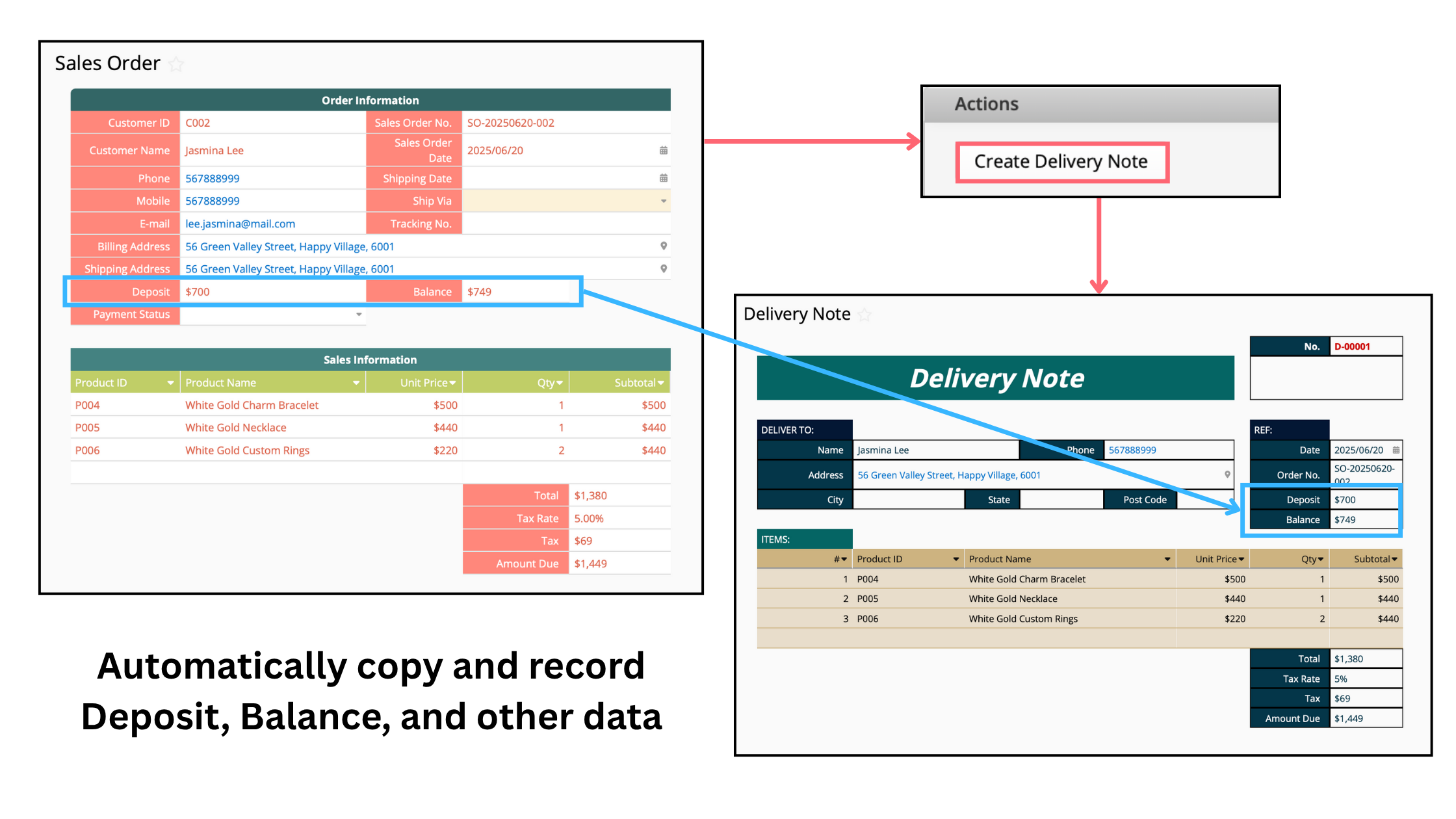

2. On the "Sales Order" sheet, add a "Create Delivery Note" Convert Record button to copy the necessary data, including "Deposit" and "Balance" to the "Delivery Note". If the button already exists, just modify it to include these new fields.

3. Once complete, clicking the "Create Delivery Note" button will instantly generate a "Delivery Note" copy and record the data from "Sales Order" sheet to "Delivery Note" sheet.

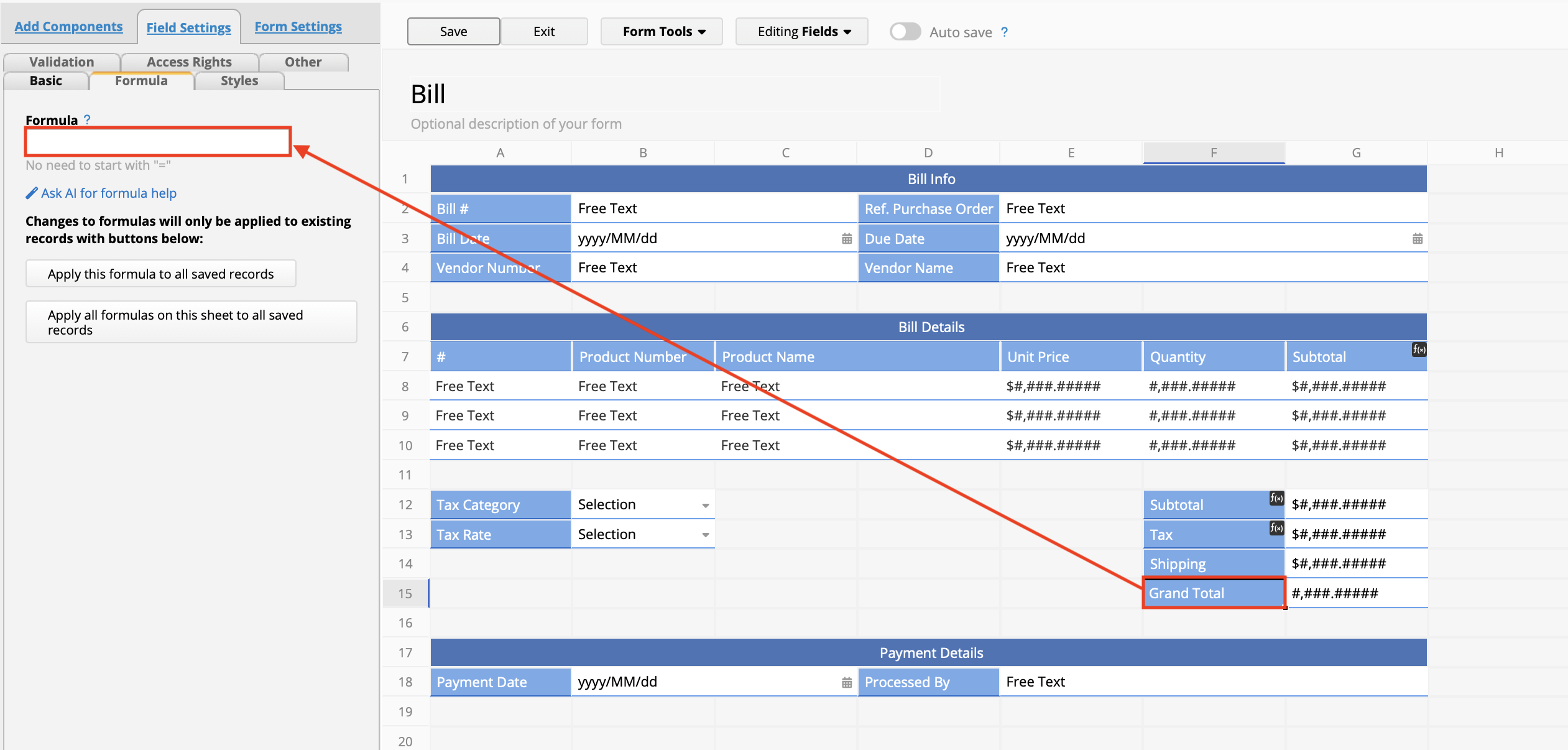

4. Since we'll be copying the "Deposit" and "Balance" amounts directly into the "Grand Total" field in the "Bill" sheet, we can remove the original template's formula rom that field to avoid automatic recalculations when product lines are posted later.

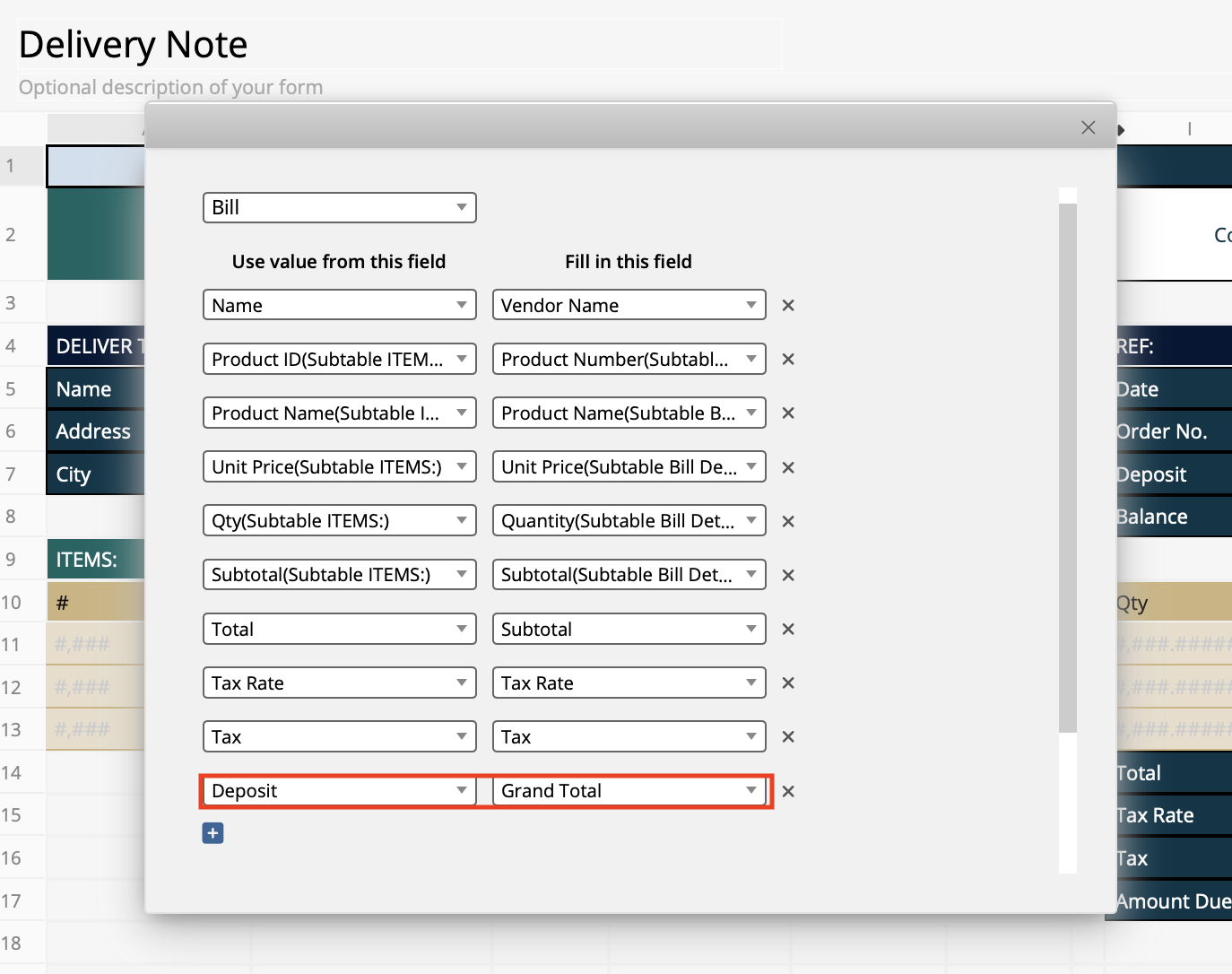

5. Create a "Post Deposit" Action Button in the "Delivery Note" sheet to copy the customer information and Subtable line items to the "Bill" sheet. The "Deposit" field should be posted in the "Grand Total" field in "Bill" sheet.

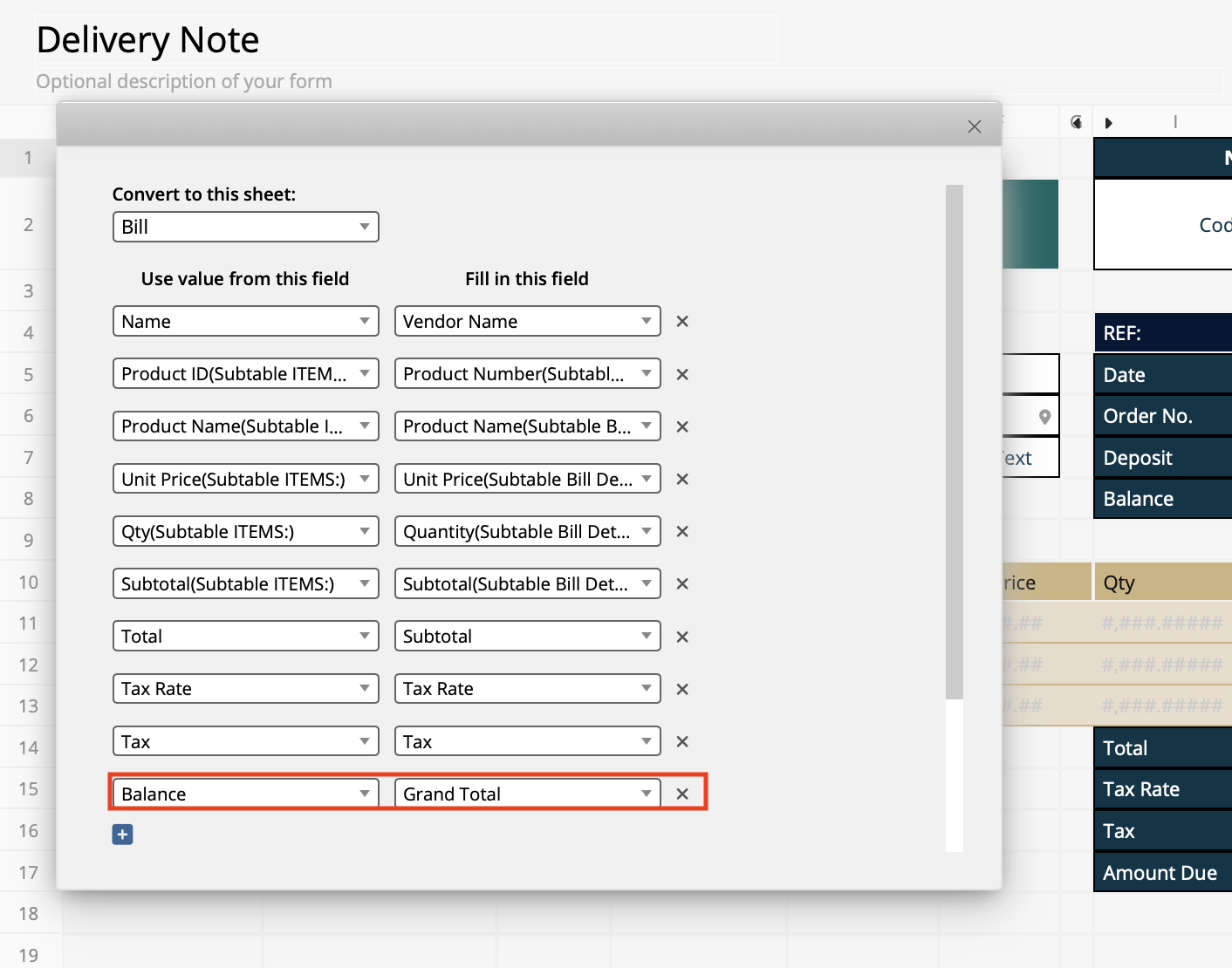

6. Create another "Post Balance" Action Button. The fields copied over are mostly the same as the "Deposit" button, but this time, use the "Balance" amount instead.

7. Once completed, clicking either "Post Deposit" or "Post Balance" will generate separate bills for each amount.

Thank you for your valuable feedback!

Thank you for your valuable feedback!